All Categories

Featured

Table of Contents

You don't need to be certified to attach Fundrise, and you absolutely do not need to invest a minimum of $25,000. Customers can begin investing on Fundrise with just $10, though you will certainly need a much greater account balance to access some of the extra special offers.

You're giving up a little bit of control in regards to choosing and managing realty financial investments, but that might be an advantage for investors that don't have the moment or experience to do the due diligence that Fundrise carries out on your behalf. Low/flexible account minimums. Reduced costs, even contrasted to comparable services.

Lets you invest in real estate funds, not individual homes No control over exactly how funds are taken care of or how properties are acquired. Financial investment takes time to pay off.

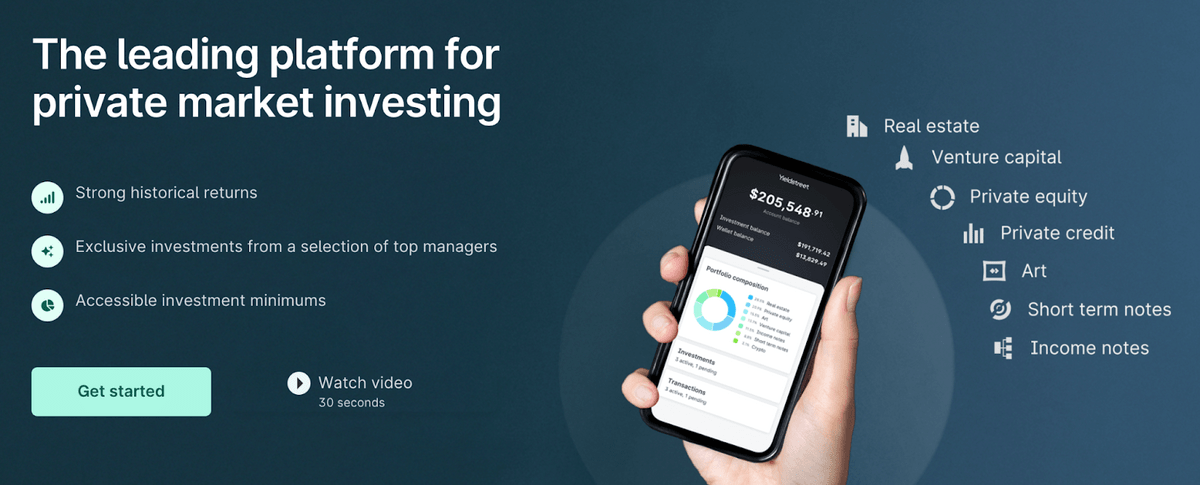

An excellent variety of deals is offered with different yields and timetables. Growth and Income REIT and Prism Fund are readily available to unaccredited investors. Have to be approved to buy many possibilities. Offers are well-vetted however still high-risk. High minimum investment thresholds. $10,000 Growth and Revenue REIT and YieldStreet Prism Fund; Varies for various other investments0 2.5% annual administration fees; Added fees differ by investmentREITs, funds, property, art, and other alternate investmentsVaries by investment DiversyFund is among the finest realty investment applications as it gives unaccredited capitalists the chance to obtain as near to direct real estate investments as the law enables.

Why is Real Estate Syndication For Accredited Investors a good choice for accredited investors?

The simple application provides investors the possibility to participate the action. While you do require to be certified to participate some of their premium chances, DiversyFund doesn't need accreditation to get into their slate of REITs and personal realty investments. The financial investments they offer aren't as fluid as supplies, bonds, or many other things you'll locate on the bigger marketand acquiring in locks you in for a variety of years prior to you can sellbut their steady returns and steady assessments make them a perfect method to expand your medium- to long-term holdings.

Their application is developed from scratch to make buying realty feel smooth and instinctive. Everything from the spending interface to the auto-invest function is made effortlessly of usage in mind, and the treatment they take into developing the app radiates via with every tap. Incidentally, if you're fascinated by the idea of living in a component of your financial investment residential or commercial property and leasing the rest, house hacking is a strategy you might intend to check out.

Easy-to-use application makes investing and tracking financial investments easy. The auto-invest attribute allows you timetable automated contributions to your investment. Just one sort of underlying asset. The largest deals need accreditation. Fairly minimal impact (just 12 current multifamily possessions). $500 Growth REITs; $25,000 Premier Possibility Fund (approved); $50,000 Premier Direct SPVs (certified) Differs based on investmentREITs, multifamily houses, personal property 5 7 years EquityMultiple has this really obvious quote on their web page from Nerdwallet: "EquityMultiple mixes crowdfunding with an extra traditional property investing technique that can cause high returns." And though we would have quit at "method" for the benefit of brevity, the Nerdwallet quote summarize EquityMultiple's total principles fairly perfectly.

Why are Accredited Investor Property Portfolios opportunities important?

Wide range of investment opportunities readily available. Accreditation is needed for all investments. A lot of possibilities have high minimal financial investments.

Lots of people aren't approved financiers, so it complies with that the majority of people don't have five or 6 numbers worth of unspent funding simply lying around. Once more, a lot of the services provided right here do need considerable minimum financial investments, yet not all of them. Spending shouldn't be the sole purview of the abundant, so we knowingly consisted of solutions that do not call for car loan-sized minimum investments.

No one suches as fees, so it's just natural that you 'd want to prevent paying big management charges or annual service charge. That said, firms need to generate income somehow. If they aren't charging you at the very least something for their effort and time, after that they're likely being paid by the people whose investment possibilities they exist.

What are the benefits of Residential Real Estate For Accredited Investors for accredited investors?

We intend to suggest solutions that have your best rate of interests in mind, not the passions of the investment originators. This is also basic and was even more of a nice-to-have than a need. At the end of the day, the majority of the actual estate investing apps out there are basically REITs that individual financiers can purchase right into, so we don't anticipate them to have a big variety of financial investments available.

Finally, we provided some factor to consider to the advised or required length of time for each solution's financial investments. Actual estate returns are determined in years, not weeks or months, however we didn't want to advise anything that would certainly lock your money up for a decade or even more. Was this write-up valuable? Thanks for your feedback!.

See what catches your eye. Not everything is for everybody yet they're all worth an appearance. Some consist of choices available for non-accredited financiers, but inspect the checklist to recognize for certain. This table supplies a summary of ten alternate financial investments, followed by even more thorough descriptions of each one: PlatformClass vs.

As a financier, you'll be taking part in the purchase and ownership of functioning farmland. But you'll be doing it via shares purchased in the farms. As it turns out, farmland has confirmed to be an excellent lasting investment. This is partly due to the fact that efficient farmland is restricted, however the international populace is enhancing.

While it's unfavorable for consumers, farmland financiers stand to acquire. What's more, farmland represents ownership in a "tough asset (Accredited Investor Real Estate Investment Groups)." That can be a big advantage in a portfolio consisted of entirely of economic assets. Your financial investment will certainly offer both returns paid of the net rental revenue of the ranch residential property, as well as resources gains upon personality of the farm.

Commercial Real Estate For Accredited Investors

You can spend in various genuine estate deals, like single-family buildings or multiunit apartment structures. You can likewise spend in excellent art, commercial airplane leasing, brand-new commercial ships, industrial financing, and also lawful offerings.

There is no management fee, and the average holding duration is 3 months. Short-term notes have no monitoring cost at all.

Latest Posts

Tax Lien Investing Nj

How Does Tax Lien Investing Work

Tax Lien Investing