All Categories

Featured

Table of Contents

Individuals that base their qualifications on annual income will likely require to send tax returns, W-2 kinds, and various other records that suggest earnings. Individuals may also think about letters from testimonials by CPAs, tax obligation lawyers, financial investment brokers, or advisors. Certified investor designations also exist in other countries and have similar demands.

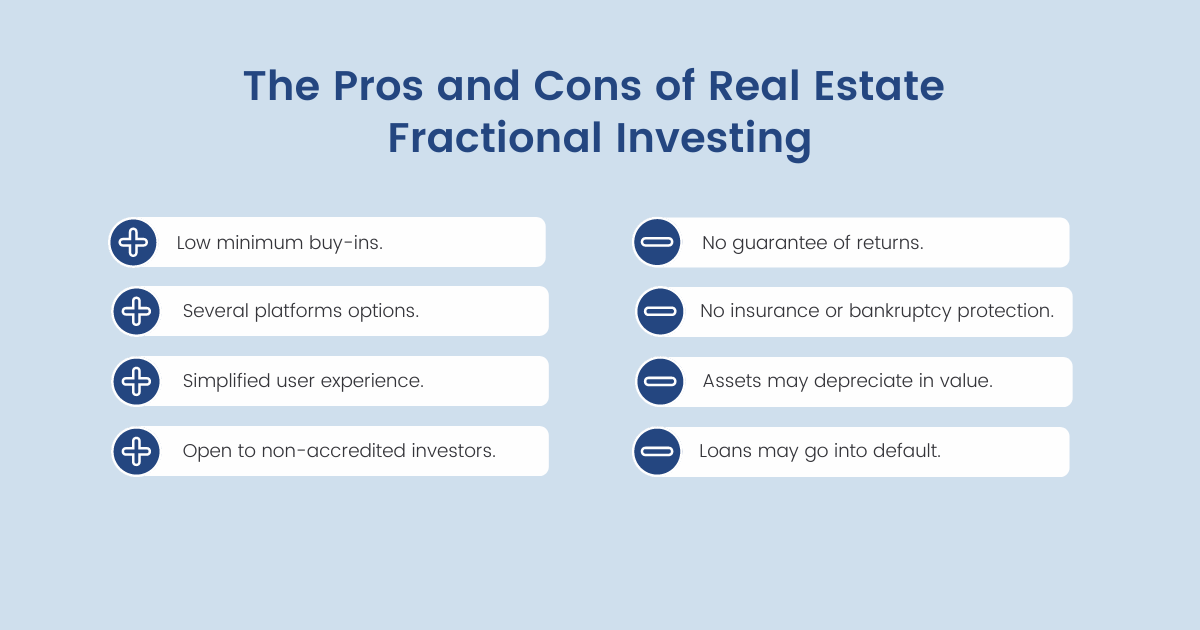

Pros Accessibility to even more financial investment opportunities High returns Increased diversification Disadvantages Risky financial investments High minimum investment amounts High performance costs Long funding lock up time The primary benefit of being a certified investor is that it offers you an economic benefit over others. Since your total assets or salary is already among the highest, being an approved capitalist allows you accessibility to investments that with much less wide range do not have accessibility to.

One of the easiest examples of the benefit of being a recognized financier is being able to spend in hedge funds. Hedge funds are mostly only accessible to accredited investors because they require high minimal investment quantities and can have higher affiliated dangers but their returns can be extraordinary.

What should I look for in a Private Real Estate Investments For Accredited Investors opportunity?

There are additionally disadvantages to being a recognized financier that relate to the investments themselves. Most financial investments that need a private to be an accredited financier come with high threat. The techniques utilized by many funds come with a greater danger in order to attain the objective of defeating the market.

Just transferring a couple of hundred or a few thousand bucks right into a financial investment will refrain from doing. Approved financiers will need to commit to a couple of hundred thousand or a couple of million bucks to take part in investments indicated for accredited financiers. If your investment goes southern, this is a lot of money to shed.

These mostly come in the form of performance charges along with administration fees. Efficiency fees can vary in between 15% to 20%. One more disadvantage to being an approved financier is the capacity to access your financial investment resources. As an example, if you acquire a few stocks online through a digital system, you can draw that money out any time you such as.

Being an accredited financier includes a great deal of illiquidity. The SEC problems standards to aid firms establish whether an investor can be taken into consideration recognized. A firm will likely have you complete a survey regarding your standing. They can also ask to evaluate your: Bank and other account statementsCredit reportW-2 or other profits statementsTax returnsCredentials issued by the Financial Sector Regulatory Authority (FINRA), if any These can aid a company establish both your monetary credentials and your class as a capitalist, both of which can impact your condition as an approved capitalist.

What does a typical Real Estate Investment Funds For Accredited Investors investment offer?

A financial investment car, such as a fund, would certainly have to determine that you certify as a certified capitalist. The benefits of being a recognized financier include access to unique investment possibilities not available to non-accredited investors, high returns, and raised diversity in your portfolio.

In particular areas, non-accredited investors also have the right to rescission. What this indicates is that if a financier determines they want to draw out their money early, they can declare they were a non-accredited capitalist the entire time and receive their refund. It's never ever a great concept to supply falsified files, such as phony tax obligation returns or monetary statements to an investment lorry simply to spend, and this can bring lawful problem for you down the line.

That being stated, each offer or each fund might have its own restrictions and caps on investment amounts that they will accept from an investor. Certified capitalists are those that satisfy certain needs concerning income, credentials, or web worth. They are commonly rich individuals. Approved investors have the chance to purchase non-registered investments provided by firms like personal equity funds, hedge funds, angel financial investments, venture funding companies, and others.

When you become a recognized financier, you are in the elite team of individuals who have the economic ways and governing clearance to make financial investments that others can not. This can imply exclusive accessibility to hedge funds, equity capital companies, certain investment funds, exclusive equity funds, and more. Accredited Investor Commercial Real Estate Deals. The Securities and Exchange Compensation argues by ending up being an accredited investor, you have a level of elegance efficient in developing a riskier financial investment profile than a non-accredited financier

It's additionally concentrated on a really certain specific niche: grocery-anchored commercial actual estate. FNRP's team leverages partnerships with top-tier national-brand tenantsincluding Kroger, Walmart, and Whole Foodsto give investors with access to institutional-quality CRE deals both on- and off-market. Unlike most of the various other websites on this checklist, which are equity crowdfunding systems, FNRP provides personal positionings that only a certified financier can accessibility.

Yieldstreet $2,500 All Investors primarily, any type of possession that falls outside of supplies, bonds or cashhave become significantly preferred as fintech services open up previously shut markets to the specific retail financier. These opportunities have actually equalized various markets and unlocked formerly unattainable money streams to pad your earnings.

What happens if I don’t invest in Accredited Investor Commercial Real Estate Deals?

You have to be a recognized capitalist to get involved in all various other Yieldstreet offerings. Discover more, and think about accessing these easy revenue investments, by today. EquityMultiple $5,000 Accredited Investors Only Some realty crowdfunding platforms only allow you to invest in residential or commercial property profiles. Nevertheless, some platforms, such as, likewise allow you to buy specific propertiesin this case, industrial actual estate (CRE).

Those financiers have accessibility to private industrial real estate bargains, funds, and even diversified temporary notes. Accredited Investor Real Estate Investment Groups. Specifically, EquityMultiple only enables its private industrial property tasks to receive financial investments from accredited capitalists. For those curious about finding out more regarding, take into consideration enrolling in an account and undergoing their qualification procedure

Table of Contents

Latest Posts

Nys Tax Foreclosures

Tax Foreclosures Property

Sales In Excess

More

Latest Posts

Nys Tax Foreclosures

Tax Foreclosures Property

Sales In Excess